Business Insurance in and around Chesapeake

Researching insurance for your business? Search no further than State Farm agent Rita Keels!

Cover all the bases for your small business

Business Insurance At A Great Value!

Do you own a yogurt shop, a photography business or a HVAC company? You're in the right place! Finding the right insurance for you shouldn't be risky business so you can focus on making this adventure a success.

Researching insurance for your business? Search no further than State Farm agent Rita Keels!

Cover all the bases for your small business

Get Down To Business With State Farm

When one is as dedicated to their small business as you are, it makes sense to want to make sure all systems are a go. That's why State Farm has coverage options for commercial auto, artisan and service contractors, business owners policies, and more.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Rita Keels is here to help you review your options. Call or email today!

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

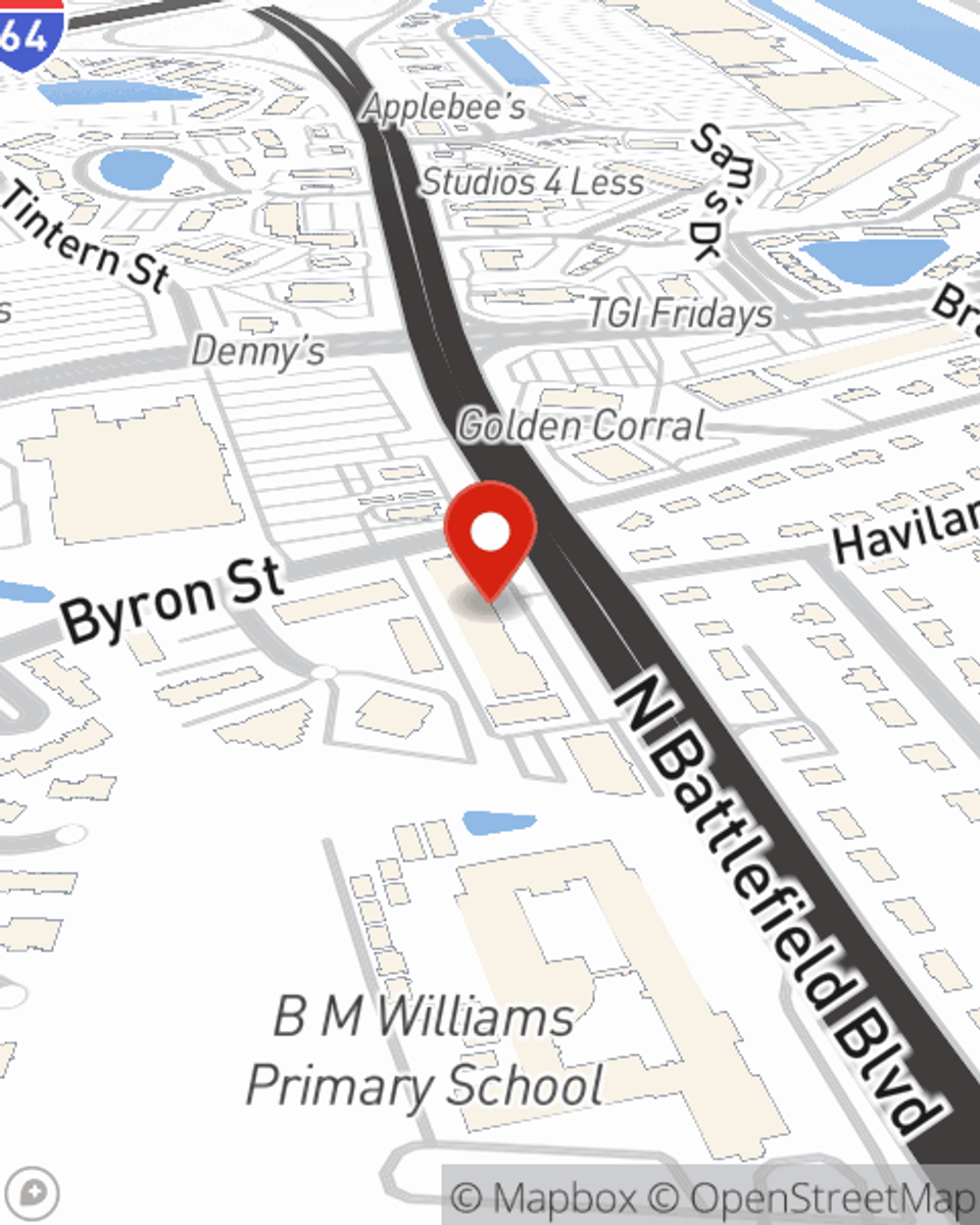

Rita Keels

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.